Your Custom Text Here

Problem:

Develop an innovative solution to address a pressing social problem in Pittsburgh. Choose one of Mayor Bill Peduto's 100 Policies to Change Pittsburgh and form a team based on mutual interests to undertake the issue.

After sharing our work experiences, myself, another HCI student, Katie Ramp, and two policy students, Beth Halayko and Shawneil Campbell, gathered around our mutual interest in anti-poverty, fighting inter-generational poverty, and providing second chances to those seeking them. We flocked to policy #80 - Bank On: Building Stronger Communities through Financial Security.

Solution:

A low-fidelity, hands-on toolkit designed to spark conversations about financial literacy and management within the home. The kit is intended to be made available at the organizing body of Bank On Greater Pittsburgh's events, the dozens of participating community and financial partners' offices, and through download from the BOGP website. Additionally, improvements to BOGP's website and bus advertisements.

Process:

The discovery phase of this project underwent several cycles as we sought to understand and identify the behavior of the "unbanked" (individuals who don't have bank accounts) and "under-banked" (individuals who have a bank account and use Alternative Financial Services, e.g. loan sharks). We also spent substantial time learning about the whole Bank On movement, a program initiated by the League of Cities that began in its first city, San Francisco, in 2006. Bank On programs are voluntary, public/private partnerships between local governments, financial institutions, and community-based organizations that provide low-income unbanked and under-banked individuals with low-cost bank accounts (or second chance bank accounts) and access to financial education. This was Bank On's first attempt in Pittsburgh.

Collectively, my team had experiences in teaching, banking, and legal empowerment. We drew from our backgrounds to apply a number of design research methods, such as interviews with major stakeholders to understand their vision and views for the program (the chairman, PM, media manager, bank representatives, other government officials); cultural probes with focus groups to uncover family history, comfort and familiarity with the subject of finances, and deeper motivations for spending and savings; fly-on-the-wall observations and field visits to BOGP events, community colleges, check-into-cash centers, and bus ride-alongs to witness environments and interactions; and competitive analysis of the services offered by banks and AFS to understand the strengths and weaknesses of each.

We visualized this information and digested it with storyboards, floor maps, physical maps, and analytical frameworks (such as know, want, learned (KWL) and willing + able matrices) to more deeply understand preferences, tendencies, and sensitivities and reveal design opportunities. A recurring challenge we faced was how to accurately scope the problem. We all wanted to make something impactful. But did we want to solve for BOGP, modifying their agenda, or reshaping it? Did we want to create something for the end user, and go through a different distribution channel? And did we want to focus on neighborhoods, or high school students? Furthermore, we had to question our own assumptions: does the under-served even need bank accounts? Are they getting along just fine without them?

We settled on modeling a new communication strategy for BOGP to make their communications more meaningful, personal, and effective. These recommendations came in three forms: (a) an expanded and improved website; (b) new bus ads; (c) an offline toolkit and conversation starter.

Not enough people were hearing about BOGP and not enough people were relating to it. When financial partners were contacted, over the phone or in person, their representatives were often unfamiliar with the program, and the fact that they were supposed to assist their customers with opening a reduced fee checking account, or removing them from the ChexSystems, a financial blacklist. No one with BOGP was addressing this major issue, which negated the ground BOGP fought to earn. We modified the site to offer up a point person at every financial and community partner, who could be responsible for answering their clients questions directly and educating other client service representatives at that branch. We also included a page with information about the ChexSystems and how to remove yourself from it, since many people weren't even aware what it was, let alone that they were on it. We made other revisions to the site, and to their bus ads, modifying the language and bringing in user stories and commentary.

Skills employed:

- Design Strategy

- Design Research Methods

- Communication Strategy

- Visual Identity

- Policy Change

- Civic Engagement

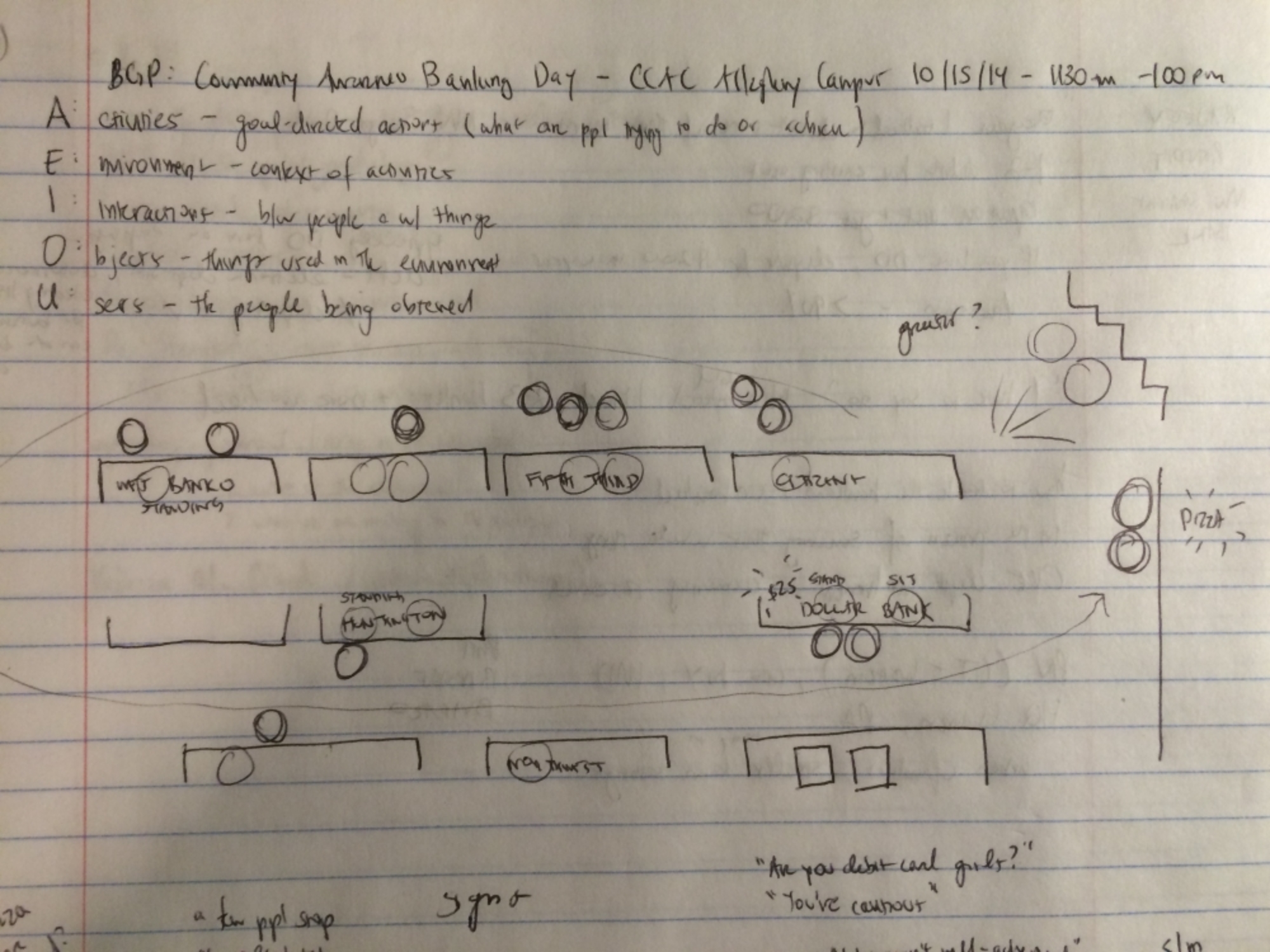

Understanding the interactions at a BOGP event at the Community College of Allegeheny County using the AEIOU design research method and physical mapping

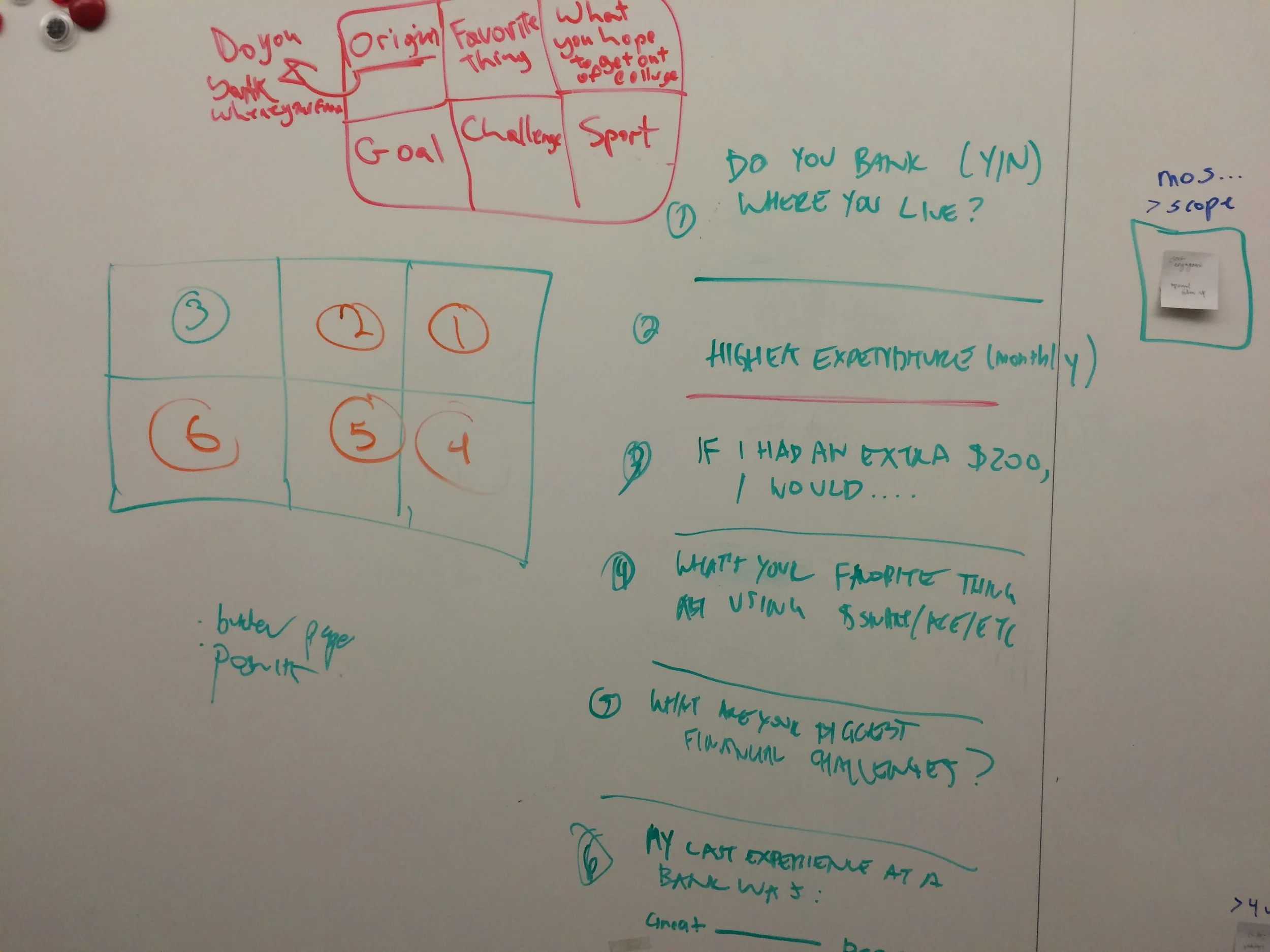

Utilizing the KWL (Know-Want-Learned) Matrix to define what we want to learn next.

Developing an interactive wall to anonymously survey our subjects.

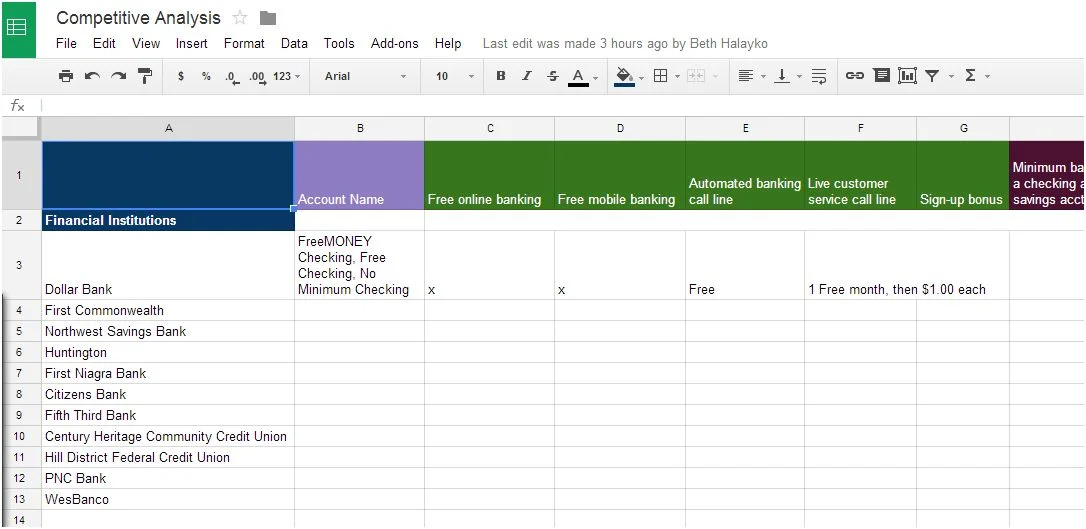

Comparing bank offerings to each other and to cash-checking organization offerings

As far as combating inter-generational poverty goes, we decided that conversations are best started within the home, and the parents often broached the topics of savings with their kids, but not always financial planning. They didn't know how to go about it. Similarly, they could be open about financial hardships with their kids, but the conversations tended to be opaque about how they would resolve the issue. The toolkit provides a friendly conversation card game and worksheets for parents and children to do together. It also invites families to contribute household items to further engage with the resources. I wanted the visual style of this toolkit to be attractive and inviting, with warm colors and a simple layout.

Not only is it the hope that BOGP can use this kit to jumpstart these conversations within their clients' homes, but we hope these toolkits will strengthen ties between BOGP and its partners and provide an additional starting point for communication between themselves, and them and their clients.

Outcome:

We showcased our process and findings during our class open house to the stakeholders who could make it, and followed up with the others through phone and email, sending copies of our materials. We know that our efforts have sparked conversation within the steering committee and that the media manager and at least one community partner are very interested in distributing toolkit.